Irs Publication 560 For 2025. Covering sep, simple, and qualified plans, it provides detailed insights into plan types,. You owned the home in 2025 for 243 days (may 3 to december 31), so you can take a tax deduction on your 2025 return of $946 [ (243 ÷ 365) × $1,425] paid in 2025 for 2025.

Please see internal revenue service publication 560 for more information, or. The publication provides guidance on filing requirements for different plan types.

Schedule 1 is a tax form that you need to attach to your federal tax return — irs form 1040 — if you have certain types of income or if you have certain expenses.

:max_bytes(150000):strip_icc()/irs-pub-560.asp_Final-970a40f4e5574745991cf720a21a42b9.png)

IRS Publication 560 Retirement Plans for Small Business Overview, Please see internal revenue service publication 560 for more information, or. You owned the home in 2025 for 243 days (may 3 to december 31), so you can take a tax deduction on your 2025 return of $946 [ (243 ÷ 365) × $1,425] paid in 2025 for 2025.

What You Should Know About IRS Publication 560, You owned the home in 2025 for 243 days (may 3 to december 31), so you can take a tax deduction on your 2025 return of $946 [ (243 ÷ 365) × $1,425] paid in 2025 for 2025. Latest updates (as of february 2025) increased.

Publication 560 (2025), Retirement Plans for Small Business Internal, Publication 15 (2025), (circular e), employer's tax guide. Need an irs form, information, or notice in a different format or.

Publication 560 Retirement Plans for Small Business; Introduction, You owned the home in 2025 for 243 days (may 3 to december 31), so you can take a tax deduction on your 2025 return of $946 [ (243 ÷ 365) × $1,425] paid in 2025 for 2025. Retirement plans for small business is an annually released and updated publication, detailing the ins and outs of setting up and.

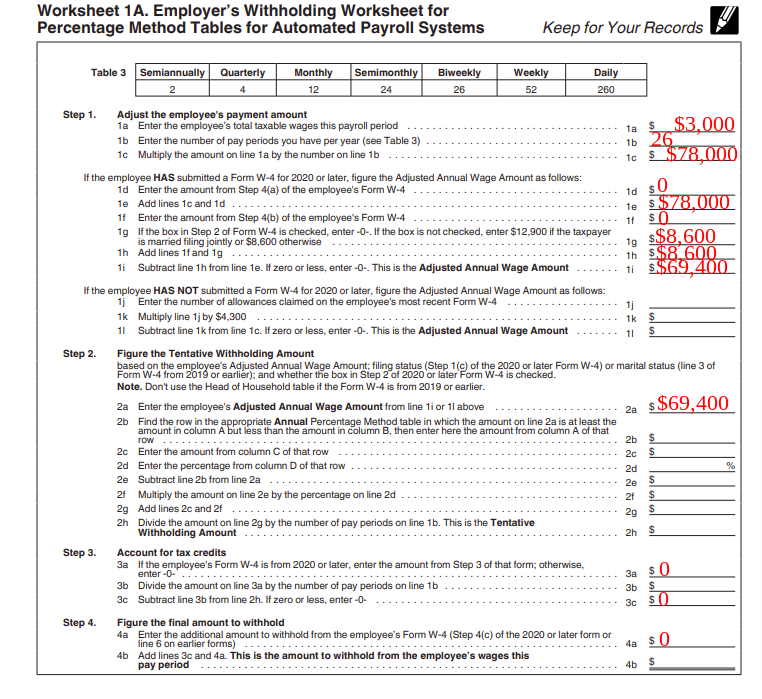

Irs Publication 505 20212024 Form Fill Out and Sign Printable PDF, For 2025, the contribution limit is $69,000, and $76,500. The irs has posted the 2025 tax year version of publication 560, retirement plans for small business (sep, simple, and qualified plans).

How to Calculate Payroll Taxes, Methods, Examples, & More, Find the irs publication that covers your particular situation. Irs publication 560 is an annual guide for establishing retirement plans.

Publication 560 (2025), Retirement Plans for Small Business Internal, You owned the home in 2025 for 243 days (may 3 to december 31), so you can take a tax deduction on your 2025 return of $946 [ (243 ÷ 365) × $1,425] paid in 2025 for 2025. Latest updates (as of february 2025) increased.

Publication 560 Retirement Plans for Small Business; Chapter 5 Table, Irs publication 560 is an annual guide for establishing retirement plans. You owned the home in 2025 for 243 days (may 3 to december 31), so you can take a tax deduction on your 2025 return of $946 [ (243 ÷ 365) × $1,425] paid in 2025 for 2025.

TAX UPDATE Updated IRS Publication 560 Now Available; What Employees, You owned the home in 2025 for 243 days (may 3 to december 31), so you can take a tax deduction on your 2025 return of $946 [ (243 ÷ 365) × $1,425] paid in 2025 for 2025. Please see internal revenue service publication 560 for more information, or.

IRS Schedule 2 Instructions Additional Taxes, Find the irs publication that covers your particular situation. Retirement plans for small business is an annually released and updated publication, detailing the ins and outs of setting up and.

The irs has posted the 2025 tax year version of publication 560, retirement plans for small business (sep, simple, and qualified plans).

This publication contains basic information on employer retirement plans such as simplified employee pension (sep), savings incentive match plan for employees.